Russel 2000 Index Fintechzoom – Click Here To Know In 2024!

Through an analysis of recent trends, key players, and investment strategies, we aim to provide insights into the opportunities and challenges that lie ahead for investors looking to navigate the dynamic landscape of Russel 2000 Index Fintechzoom.

Russel 2000 Index Fintechzoom is a key benchmark for tracking the performance of small-cap companies in the United States, while FintechZoom is a prominent platform covering news and developments in the fintech industry.

This article delves into the intersection of these two realms, exploring how the growth and evolution of the fintech sector have impacted the performance of the Russell 2000 Index.

What Is The Russel 2000 Index Fintechzoom? – Let’s Explore Together!

The Russel 2000 Index Fintechzoom is a stock market index that serves as a benchmark for tracking the performance of small-cap companies in the United States.

Specifically, russell 2000 index “fintechzoom” includes approximately 2,000 small-cap stocks, which are considered to be smaller publicly traded companies compared to those included in larger indices like the S&P 500.

- Composition: Russell 2000 index “fintechzoom” is composed of 2,000 small-cap stocks, representing a diverse range of industries and sectors within the U.S. economy. These companies typically have lower market capitalizations compared to large-cap and mid-cap companies.

- Benchmarking: Investors and financial professionals use the Russell 2000 Index as a benchmark to gauge the performance of small-cap stocks and compare it to broader market indices such as the S&P 500 (which tracks large-cap stocks) or the Russell 3000 Index (which includes large-cap, mid-cap, and small-cap stocks).

- Market Coverage: Small-cap stocks are often viewed as having higher growth potential but also higher volatility compared to larger companies. The Russell 2000 Index provides insights into the performance of these smaller companies and their impact on the overall market.

- Investment Strategies: Many investment funds, including mutual funds and exchange-traded funds (ETFs), are designed to track or replicate the performance of the Russell 2000 Index. Investors may choose to invest in these funds to gain exposure to small-cap stocks and diversify their portfolios.

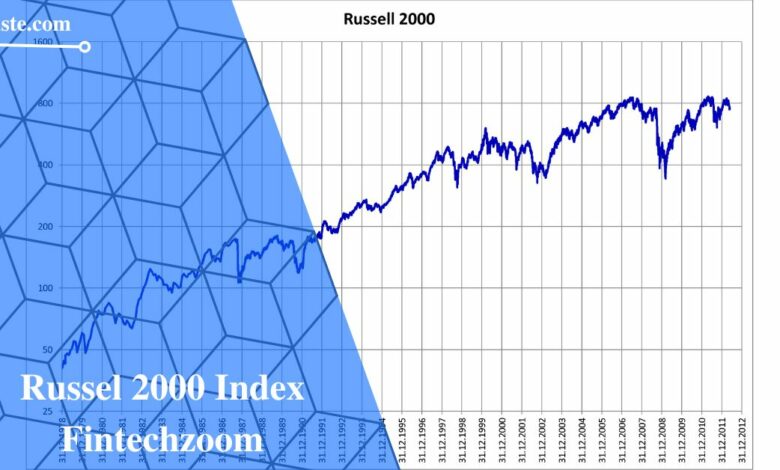

Historical Performance And Significance – Have A Look At It!

The historical performance and significance of the Russell 2000 Index provide valuable insights into the dynamics of small-cap stocks and their impact on the overall market.

Market Indicator:

The Russell 2000 Index is a widely recognized market indicator for small-cap stocks in the United States. It serves as a barometer for assessing the performance of smaller companies relative to larger ones, such as those included in the S&P 500 Index.

Performance Volatility:

Small-cap stocks, as represented by the Russell 2000 Index, are known for their higher volatility compared to large-cap stocks. This volatility can lead to significant russell 2000 index fintechzoom price fluctuations and presents both opportunities and challenges for investors.

Economic Barometer:

The performance of the Russel 2000 Index Fintechzoom is often viewed as a reflection of the broader economic environment, particularly in terms of economic growth, business sentiment, and market conditions for smaller companies.

Also Read: Limestone Commercial Real Estate Houston Reviews – Click Here To Know!

Sector Diversity:

The Russell 2000 Index encompasses a diverse range of sectors and industries, including technology, healthcare, consumer goods, finance, and more. This diversity provides investors with exposure to various segments of the economy.

Investment Strategies:

Investors and fund managers often use the Russel 2000 Index Fintechzoom as a benchmark for small-cap investment strategies. Funds designed to track or replicate the russell 2000 index fintechzoom pdf performance are commonly used by investors seeking exposure to small-cap stocks.

Overview Of Fintechzoom – Delve In!

FintechZoom is a prominent platform that focuses on delivering news, analysis, and insights related to the fintech industry. Here’s an overview of FintechZoom and its key features:

Purpose and Focus:

FintechZoom aims to provide comprehensive coverage of developments, trends, and innovations in the fintech (financial technology) sector.

This includes a wide range of topics such as digital payments, blockchain technology, artificial intelligence in finance, financial inclusion, regulatory updates, and more.

Audience:

The platform caters to a diverse audience interested in fintech, including investors, financial professionals, entrepreneurs, technology enthusiasts, regulators, and individuals seeking information about the evolving landscape of financial services.

Content Offerings:

News Coverage: FintechZoom delivers timely news articles covering industry events, company announcements, market trends, and regulatory changes impacting the fintech sector.

Also Read: Api Shift Select – A Comprehensive Guide In 2024!

Educational Resources:

FintechZoom may also offer educational resources, guides, and tutorials to help readers enhance their understanding of fintech concepts, technologies, and investment opportunities.

User-Friendly Interface:

FintechZoom typically features a user-friendly website interface that allows visitors to navigate easily, access different sections such as news, analysis, and interviews, and explore content based on specific areas of interest within fintech.

Mobile Accessibility:

In today’s digital age, FintechZoom likely offers mobile accessibility through dedicated mobile apps or a responsive website design, enabling users to stay updated on fintech news and insights on the go.

Global Coverage:

FintechZoom may cover fintech developments from around the world, highlighting both established fintech hubs and emerging markets where innovative solutions are reshaping financial services.

Analysis Of The Russell 2000 Index Performance – Don’t Miss Out!

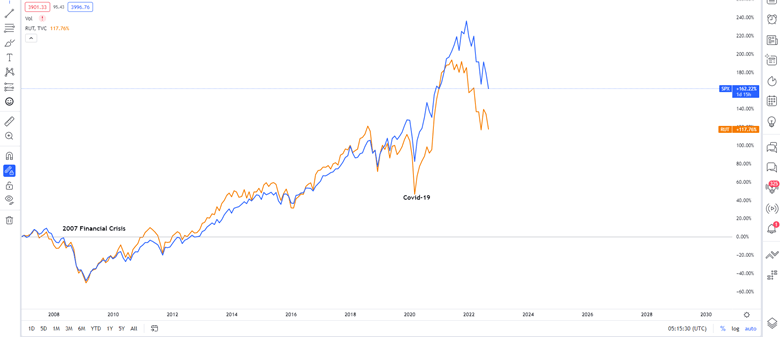

Analyzing the performance of the Russel 2000 Index Fintechzoom involves assessing various factors that influence russell 2000 index “fintechzoom” movements, trends, and overall significance in the financial markets.

Recent Performance Trends:

- Volatility: The Russell 2000 Index is known for its volatility, and recent trends may reflect this characteristic. Fluctuations in small-cap stocks, driven by market sentiment, economic indicators, and sector-specific developments, can lead to rapid movements in the index.

- Market Sentiment: Changes in market sentiment, such as optimism about economic recovery, concerns about inflation, or geopolitical events, can impact the Russell 2000 Index. Positive sentiment often leads to upward movements, while negative sentiment can result in declines.

Also Read: Best Asset Management Bakersfield California – Get Informed!

Factors Influencing Performance:

- Economic Indicators: Key economic indicators such as GDP growth, unemployment rates, consumer spending, and inflation levels can influence the Russell 2000 Index’s performance. Strong economic data generally supports small-cap stocks, while economic uncertainties may lead to volatility.

- Interest Rates: Monetary policy decisions and changes in interest rates by central banks, such as the Federal Reserve in the U.S., can affect borrowing costs, business investment, and overall market sentiment, impacting small-cap stocks and the Russell 2000 Index.

- Sector Rotation: Shifts in investor preferences and sector rotation can also impact the russell 2000 index fintechzoom pdf. For example, during periods of economic expansion, sectors like technology, healthcare, and consumer discretionary may outperform, driving the index higher.

- Market Liquidity: Liquidity conditions in the market, including trading volumes, bid-ask spreads, and investor participation, can influence the Russell 2000 Index’s ability to reflect underlying russell 2000 index fintechzoom stocks prices accurately.

Performance Comparison with Traditional Sectors:

- Tech Sector Influence: The technology sector’s performance often has a significant impact on the Russell 2000 Index due to the presence of small-cap tech companies. Positive developments in tech, such as innovations, earnings growth, and market leadership, can boost the index.

- Financial Sector Dynamics: Small-cap companies in the financial sector also contribute to the index’s performance. Factors such as interest rate changes, regulatory developments, and loan growth can affect financial russell 2000 index fintechzoom stocks and, by extension, the Russell 2000 Index.

- Consumer and Industrial Sectors: Trends in consumer spending, industrial production, and business sentiment within small-cap companies’ sectors play a role in determining the index’s performance.

Impact Of The Fintech Industry On The Index – Learn And Thrive!

Integration of Fintech Companies in the Index:

Fintech companies have increasingly gained prominence and representation within the Russel 2000 Index Fintechzoom. As innovative disruptors in the financial services sector, these companies bring unique growth opportunities and market dynamics to the index.

The inclusion of fintech firms reflects the evolving landscape of finance, where digital technologies, online platforms, and innovative solutions are reshaping traditional banking, payments, lending, and investment services.

Performance Comparison with Traditional Sectors:

Fintech companies within the Russel 2000 Index Fintechzoom stocks often exhibit distinct performance trends compared to traditional sectors such as manufacturing, healthcare, or consumer goods.

During periods of technological innovation, regulatory advancements, or market disruptions, fintech stocks may outperform or experience higher volatility, impacting the overall index performance.

Influence on Market Sentiment and Investor Interest:

The presence of fintech companies in the index can influence market sentiment and investor interest.

Positive developments in the fintech industry, such as successful product launches, partnerships with established firms, or regulatory approvals, can drive optimism and investment inflows into fintech-related stocks.

Conversely, negative news, regulatory challenges, or cybersecurity concerns within the fintech sector may lead to cautious sentiment and affect the index’s performance.

Also Read: Spy Max Pain – Unveiling The Mystery In 2024!

Growth Potential and Innovation Dynamics:

Fintech companies often represent high-growth potential due to their innovative business models, technological expertise, and ability to address market gaps or inefficiencies.

Their presence in the Russell 2000 Index Fintechzoom stocks reflects investors’ appetite for exposure to innovative sectors and the potential for disruptive technologies to drive long-term growth and value creation.

Key Players And Trends In The Fintech Industry – Discover New Horizons!

Key Players in the Fintech Industry:

- PayPal: A leading global payments platform that enables digital and mobile payments for consumers and businesses worldwide.

- Visa: A multinational financial services corporation specializing in digital payments, Visa facilitates electronic funds transfers and card transactions globally.

- Stripe: A technology company that provides payment processing software and APIs for online businesses, empowering them to accept payments securely and efficiently.

- Robinhood: A fintech company offering commission-free stock and cryptocurrency trading through its user-friendly mobile app, democratizing access to investing.

Emerging Trends in the Fintech Industry:

- Blockchain Technology: Blockchain is revolutionizing financial services with russell 2000 index “fintechzoom” decentralized and secure ledger system, enabling efficient and transparent transactions.

- Artificial Intelligence (AI): AI-powered solutions are enhancing customer experiences, risk management, fraud detection, and personalized financial advice in fintech.

- Digital Wallets: The rise of digital wallets like Apple Pay, Google Pay, and Samsung Pay is reshaping how consumers make payments, emphasizing convenience and security.

- Open Banking: Open banking initiatives promote collaboration among financial institutions and fintechs, allowing seamless data sharing and innovative financial services.

Also Read: No Denial Payday Loans Direct Lenders Only No Credit Check – Explore In 2024!

Investment Strategies For Russell 2000 Index In the Fintech Sector – You Should Know!

- Diversification: Spread investments across multiple fintech companies within the Russell 2000 Index to reduce risk exposure and capture growth opportunities across various subsectors.

- Research and Due Diligence: Conduct thorough research and due diligence on fintech companies included in the index, evaluating their business models, financial health, market positioning, and growth prospects.

- Long-Term Perspective: Adopt a long-term investment horizon when investing in the Russell 2000 Index’s fintech sector, as fintech companies may experience volatility but can offer significant growth potential over time.

- Monitor Regulatory Environment: Stay informed about regulatory developments and compliance issues affecting the fintech sector, as regulatory changes can impact companies’ operations and financial performance on russell 2000 index fintechzoom chart.

- Tech Adoption and Innovation: Focus on fintech companies within the Russell 2000 Index Fintechzoom chart that demonstrate strong technology adoption, innovation capabilities, and scalability in delivering disruptive financial services.

- Risk Management: Implement risk management strategies such as setting stop-loss limits, diversifying across asset classes, and regularly reviewing portfolio performance to mitigate downside risks in the volatile fintech sector.

Frequently Asked Questions:

1. What criteria are used to select companies for inclusion in the Russell 2000 Index?

Companies included in the Russell 2000 Index are selected based on their market capitalization, with the index typically comprising 2,000 small-cap stocks.

2. How often does the Russell 2000 Index undergo rebalancing?

The russell 2000 index fintechzoom stocks undergoes annual rebalancing to ensure it accurately reflects the small-cap segment of the market and includes newly eligible companies.

3. Can investors directly invest in the Russell 2000 Index?

Yes, investors can gain exposure to the Russell 2000 Index through various financial instruments such as exchange-traded funds (ETFs) and mutual funds designed to track its performance.

4. What sectors or industries are commonly represented in the Russell 2000 Index?

The russell 2000 index fintechzoom pdf encompasses a diverse range of sectors, including technology, healthcare, consumer goods, financial services, industrials, and more, providing broad exposure to small-cap companies across various industries.

5. What is the best performing Russell 2000 Index fund?

Funds like the iShares Russell 2000 ETF (IWM) and the Vanguard Russell 2000 ETF (VTWO) are often considered among the top performers in this category.

6. Is the Russell 2000 Index a good investment?

Investing in the Russell 2000 Index can offer potential for higher returns over the long term but comes with increased volatility and depends on individual investment goals and risk tolerance.

7. Which index fund has shown the highest returns?

ICICI Prudential Nifty 50 Index Fund-Growth ranks among India’s top 10 index funds and falls under the Large Cap Index category. Over the previous year, it has yielded returns of 15.09 percent. Since its inception, the fund has maintained an average annual return of 14.74 percent.”

In A Nutshell:

Russel 2000 Index Fintechzoom chart serves as a valuable benchmark for tracking the performance of small-cap companies, offering investors insights into the dynamic landscape of the market and opportunities for diversification and growth.

Must Read: